Forex Margin Basics

Think of forex margin as a collateral or a security deposit required to secure trade through forex broker.

It should not be confused as a transaction cost or broker fee. It is simply a portion of my account equity set aside and allocated as a deposit with my forex broker.

Use of forex margins can significantly magnify any profit or loss in forex trading.

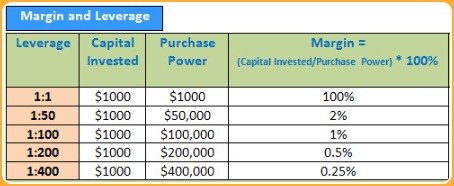

Forex margins are usually represented in percentage. The standard practice for minimum margin requirement for major currency pairs is 1%.

However this requirement should be flexible upon your need and your broker's offer. The minimum margin requirement can also be as low as 0.25%.

Understand how forex margins relate to your trading style in the table below.

Forex Margin and Leverage Chart

Forex Margin and Leverage Chart

So in any event, the minimum margin requirement amount is all a trader is risking at any event.

This guarantees that a trader will never pay a debit balance in the event of loss as a result of trading.

Forex Margins and Other Related Terms

Forex Margin Terminology

Forex Margin Terminology

Balance

Balance refers to the value of funds in the account. It excludes profits and losses made on any open positions.

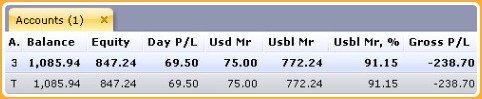

In the figure above, my balance is at $1085.94

Equity

Equity refers to the "floating" value of funds in the account. It includes profits and losses on any open positions.

In another words, equity reflects to me the real time true value of my account.

Mathematically, ...

= Usable Margin + Used Margin

When all open positions are liquidated, the account's equity becomes the account's balance.

In the figure above, my equity is

= $1085.94 - $238.70

= $847.24

Margin Account

Margin account refers to an account that allows a trader to borrow money from a forex broker.

In any event of losing trade, the maximum amount any trader can lose at any given time can not exceed the margin account amount.

Used Margin (Usd Mr)

Used margin is the amount of account equity locked in by broker to maintain open positions. I think of used margin as a security deposit to open a live trade.

I must maintain minimum of this amount with my broker for my open trades to remain active. This used margin is kind of security deposit so it is credited back to my account when my open positions are closed.

In the figure, my used margin is set at $75 per 1 lot (=10,000 units) by my broker. This margin may vary one forex broker to another.

Usable Margin (Usbl Mr)

Usable margin amount reflects the amount of equity that is available to open new trades.

Mathematically,

In the figure, my usable margin is

= $772.24

Usable Margin Percentage (Usbl Mr.%)

Usable margin percentage runs on a scale from 0% to 100%. Its absolutely imperative that traders always know this usable margin percentage at all the time of trading.

I use this number to determine when to cut my losses and when to hedge my position in order to prevent adverse effect against my loosing trade.

The good rule of thumb is to always maintain usable margin percentage above 90%.

Mathematically,

In the figure, my usable margin percentage is at 91.15%, i.e.,

= 91.15%

Holy Trinity of Forex Margin Trading

Think of equity, used margin, and usable margin percentage as a holy trinity of forex margin trading.

I use these basic information to determine my entry size, and cut my losses.

Every trader must master these basic concepts at any cost.

Think you are now better informed on forex margin basics?

-

Return to

- Forex Margin

- Money Management

- Home

Have your say about what you just read! Leave me a comment in the box below.