What Is The Balance of Payments Theory?

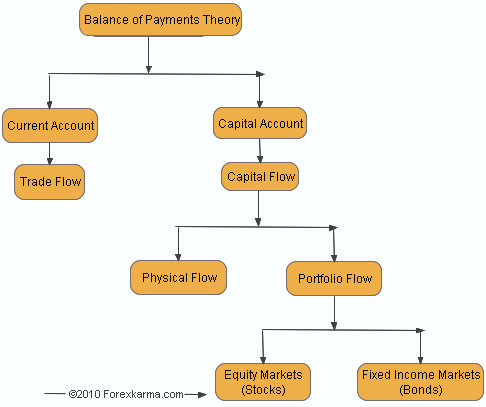

Balance of payments theory consists of current account and capital account.

Current Accounts

Current accounts consists of trade flows. Trade flows measure exports and imports of a country. Trade flows can be negativ or positive.

When a country imports more goods/services than it exports to foreign countries, then the country experiences negative trade flow or trade deficit.

When a country exports more goods/service than it imports to foreign countries, then the country experiences positive trade flow or trade surplus.

In general, country with trade deficit will likely see its currency devalue whereas country with trade surplus will experience its currency appreciate.

For example, if the U.S. run on large trade deficit compared to its European counterpart, namely Germany then the U.S. dollar will likely devalue while the Euro will appreciate.

The Balance of Payments Flowchart

The Balance of Payments Flowchart

Capital Accounts

Capital account consists of capital flows. Capital flow further consists of physical flow and portfolio flow.

Physical Flows

Physical flows refer to actual cash movement from one country to another.

For instance, when the international corporation like the U.S. based Google make acquisition of Indian start-up IT firm, the U.S. dollar will leave the country to pay for the acquisition cost.

This scenario is true especially when such acquisition consist more cash than stocks.

Portfolio Flows

Portfolio flows consists of flow of capital in equity markets like stocks and fixed income market like bonds.

In theory,

When Balance of Payments = 0,

then only country can maintain its status quo in terms of economy and currency valuation.

Any change in this equation so lead to either devaluation or appreciation of it currency.

Shortcomings of Balance of Payments Theory

This theory focuses primarily on goods and services while discounting the international capital flow into a country.

Variables like trade flow and capital flow can turn the equilibrium in any direction defying the balance of payments forecasting model.

For instance, the U.S. may have large trade deficit, however; capital flows from all parts of the world to harvest safe haven dollar investment in both equities and bonds can strengthen dollar because of its demand in the global market.

Reference: The Bureau of Economic Analysis

-

Return to

- Balance of Payments Theory

- Forex Fundamentals

- Home

Have your say about what you just read! Leave me a comment in the box below.