Forex Leverage -A Double-Edged Sword

In forex leverage allows me to control large sum of money with small deposit called margin.

In another words, forex trader can make trades with deposits less than the full value of the position.

Archimedes of Syracuse (287 B.C. - 212 B.C.), a Greek mathematician, physicist, engineer, inventor, and astronomer well spoke of using leverage...

Give me a lever long enough and a place to stand and I will move the entire earth.

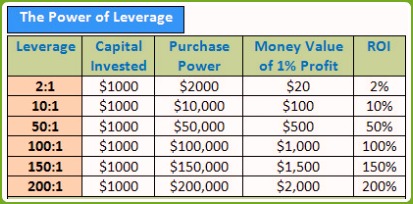

Leverage in forex is expressed as ratios: 1:1, 1:50, 1:100, 1:200, 1:400.

Let's study the chart below to understand how leverage is created in forex.

Forex Leverage Example Chart

Forex Leverage Example Chart

Mathematically,

= $100,000/$1,000

= 100

This leverage ratio of 1:100 is translated as following:

For every $1 I deposit in my forex broker's account, my broker in return deposits $100 in my margin account. So, if I deposit $1000 then my broker deposits $100,000 in my trading account.

So with just $1000 of my own money, I can control $100,000 for my trading purposes. By doing so I created a leverage in forex.

Why Use Leverage In Forex?

Leverage has been in use from the early dawn of our civilization primarily to cope up with daily necessities.

In the medieval era leverage was employed probably just to lift heavy stones to build houses.

But in the modern era leverage has been used extensively in finance and commerce. When I am buying one million dollar house with only 10% down payment, I am essentially using leverage.

Leverage adds glamor to forex trading. It is what makes so many traders gravitate to forex trading as compared to equities and other securities market.

Consider following forex leverage example for illustration...

Assume: At 7:00 A.M. EUR/USD is trading at 1.4500.

By noon EUR/USD trails to a high of 1.4600.

This is a solid 100 PIPs move in forex. I will be making big smiley face all day for this kind of gain in a matter of few hours.

However if we run math, EUR/USD movement from 1.4500 to 1.4600 turns out to be fractional and minimal.

= 1.4600 - 1.4500

= 0.01

= 1/100

So this is just one one-hundredth (=1/100) move, i.e. one-hundredth of a dollar or just a penny! Not a lot.

But use of leverage in forex helps me to magnify this mere gain of $1/100 to a whopping $1000.

Let's calculate PIP dollar value using leverage:

Mathematically, PIP dollar Value =

(Assume my trading size is 100,000 lots.)

= (0.01/1.4600) x Euro 100,000

= Euro 684.93

Next, let's convert Euro to dollar value.

At the exchange rate of EUR/USD at 1.4600:

1 Euro can buy U.S. $1.4600

684.93 Euros can buy more U.S.

So we multiply,

=$1.4600 x 684.393

= $1000

Hence, leverage in forex is the secret behind huge wind fall profits in forex trading. Be that as it may, leverage can magnify losses in losing trades.

In the above forex leverage example, had the trade turned against my position, say by same 100 PIPs then my losses would have been magnified by the same amount, i.e, $1000.

This is also why leverage is considered double edged sword. If I make winning trades using leverage then my profits are huge. Likewise if I make losing trades my losses are also huge.

So traders be aware of using high leverage even though your forex broker suggests so.

Next learn more on forex leverage trading.

Give your shout why leverage in forex is a double-edged sword?

-

Return to

- Forex Leverage

- Money Management

- Home

Have your say about what you just read! Leave me a comment in the box below.