Currency Substitution Model

Currency substitution model states that the shifting of private and public portfolios from one nation to another can significantly influence exchange rates.

This model plays out well in emerging nation like India where investment dollars flows in and out with enormous effect.

With an advent of technology, investing around the globe has become just a breeze through. This technological breakthrough has given investors an edge to change their assets portfolio from domestic to foreign currencies and vice versa, which is known as currency substitution.

This model works well in conjunction with the monetary model.

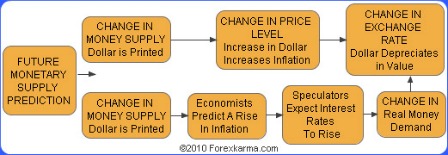

When the investment sentiment shift occurs in a nation's money supply, investors act accordingly shifting their portfolios in expectation for a possible exchange rate changes.

Hence, investors in essence turn the monetary model into a self fulfilling prophecy.

Currency Substitution Flowchart

Currency Substitution Flowchart

Case Study

Between 2007 and 2009, the Federal reserve in the US - and other central banks across the globe was pumping more money into their respective financial markets to subdue sub-prime mortgage crisis.

When money supply is increased, say in case of the US dollars, it would spark inflation, decrease demand for dollar ultimately causing dollar to depreciate.

So followers of this model would dump the dollar and fulfill monetary model prophecy, i.e. change in money supply results in change in price level hence change in exchange rates.

In this case dollar would depreciate.

Limitations

This model discounts various variables which in fact are the very driving force in the financial markets.

This model might work well in emerging markets where investment dollars flow in and out with enormous effect.

However, this theory comes under serious attack in the case of established markets in the developed nations where equity and fixed income markets make up the big chunk of financial market.

Even in the case of increase in money supply, dollar appreciated against Euro and other major currencies from December 2009 to June 2010 mainly due to possible sovereign debt default by Greek, followed by Spain and Portugal in the Euro zone.

Have your say about what you just read! Leave me a comment in the box below.