Forex Margin Trading Case Studies

Forex margin trading is one of the most glamorous reason behind forex trading for me. I can trade only with 1% margin requirement or even lower. This also implies I can equally magnify profit and losses.

Forex trading on margin should be carried out with extra caution in order to prevent margin calls in the case of losing trade.

One of the very basic concept of money management is to know all the time: equity, used margin, usable margin and usable margin percentage.

I think of equity, used margin, and usable margin percentage as a holy trinity of forex trading on margin. I highly recommend you master these basic concepts. Click here to learn more.

Let's walk through few practical exercises to illustrate how forex margin trading should be carried out.

I will assume following to start out with my mini account...

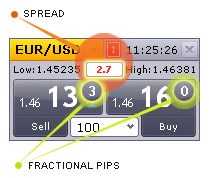

Market Order Window

Market Order Window

- Principal Balance $10,000

- Equity = $10,000

- 1:200 Leverage

- 1 PIP = $1 per 1 lot for Mini Account

- Bid/Ask Spread 2.7 PIPs per 1 lot = 2 x 2.7 = $5.4

- Trade Size = 1 lot = 10,000 or 10K units for mini account

- Margin requirement for my broker = $75 per 10K lot

- Usable Margin = 100%

- Entry size = 1.5% of Account Balance (=$10,000)

I'll remain disciplined not to open trades with more than 1.5% of my balance at any given time during buffer building period.

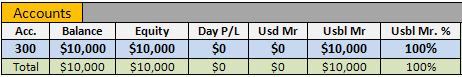

So my account looks like this to start out with...

Beginning Account Balance

Beginning Account Balance

Scenario I

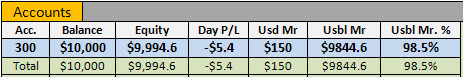

I open 2 lot EUR/USD buy with 1.5% entry on my $10,000.

- Buy 2 lots at 1.46160 with bid/ask spread 2.7 PIPs per 1 lot

(spread costs = 2 x 2.7 =$5.4) - Entry Size = 1.5% of $10,000 = $150.

(My broker requires $75 as margin per 1 mini lot trade. So with $150 I can open 2 mini lots trade.) - Equity I = Floating Value + Profit - Losses - Spread

= $10,000 + $0 - $0 - $5.4 = $9,994.6

(As you can see $5.4 is factored in as spread between bid and ask in opening 2 lots trade.) - Used Margin I = 2 x $75 = $150

- Usable Margin I = Equity I - Used Margin I

= $9,994.6 - $150 = $9,844.6 - Usable Margin Percentage I = (Usable Margin/Equity) x 100%

= ($9,844.6/$9,994.6) x 100% = 98.5%

So my account will now look as following...

Scenario I - Account Balance

Scenario I - Account Balance

Scenario II

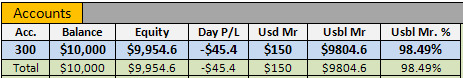

The market moves 20 PIPs against my trade. So the market is now trading at 1.46360.

- 20 PIPs negative trade damages

= Losses = 20 x $2 = $40

($2 per PIP per 2 mini lots) - Equity II = Floating Value + Profit - Losses - spreads

= $10,000 + $0 - $40 - $5.4 = $9,954.6 - Used Margin II = $150

- Usable Margin II = Equity II - Used Margin II

= $9,954.6 - $150

= $9,804.6 - Usable Margin Percentage II = (Usable Margin II/Equity II) x 100%

= ($9,804.6/$9,954.6) x 100% = 98.49%

Now my forex margin trading account will look as following...

Scenario II - Account Balance

Scenario II - Account Balance

Scenario III

The market moves 50 more PIPs against my trade. So the market is now trading at 1.46860.

- 50 PIPs negative trade damages

= Losses = 50 x $2 = $100

(Hence total losses = $40 + $100 = $140) - Equity III = Floating Value + Profit - Losses - spreads

= $10,000 + $0 - $140 - $5.4

= $9,854.6 - Used Margin III = $150

- Usable Margin III = Equity III - Used Margin III

= $9,854.6 - $150

= $9,704.6 - Usable Margin Percentage III = (Usable Margin III/Equity III) x 100%

= ($9,704.6/$9,854.6) x 100%

= 98.47%

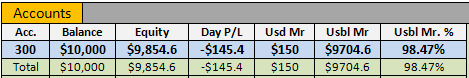

Now my forex margin trading account will look as below...

Scenario III - Account Balance

Scenario III - Account Balance

So continuing with this trend, with usable margin of $9704.6 and at $2 per PIP, the market would have to move 4852.3 PIPs before I will get a margin call (= 9704.6/2 = 4,852.3 PIPs), i.e. the market has to come to 1.42007 from 1.46860.

The bottom line is forex margin trading could be glamorous in one sense but I have learned from my past follies that maintaining Usable Margin Percentage 90% and Above At All the Time is absolutely must to withstand any draw-downs while forex trading on margin.

What are your forex margin trading practices?

-

Return to

- Forex Margin Trading

- Money Management

- Home

Have your say about what you just read! Leave me a comment in the box below.