Double Bottom Pattern - Simple and Elegant Candlestick Reversal Pattern

A double bottom is a bullish reversal pattern. It is easier to spot and also appears frequently.

This pattern is also a slight variation of inverse head and shoulders pattern and triple bottom pattern.

The only main difference is that it only has two troughs while other two bears three troughs.

DOUBLE BOTTOM PATTERN FORMATION

Consider a downtrend with each successive lower lows and higher lows.

Double Bottom Pattern

Double Bottom Pattern

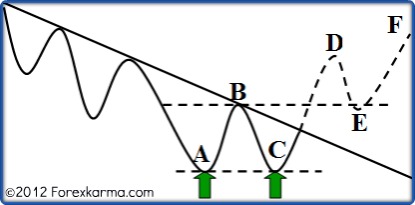

In the above figure, the market sets the lowest point at A on increased volume. The price then rallies to point B which is expected as a reaction.

Consider the swing B-C-D.

The market attempts to set new low point as expected for the downtrend to be maintained. However, the market stalls at point C at about the same support level as the previous trough.

Also the volume has declined raising a yellow flag of caution.

Next consider the swing C-D-E.

The price then rallies and violates the downtrend. When the price rallies above the resistance line represented by the dotted line B-E, then the formation of double bottom is complete.

Finally consider the swing D-E-F.

The bears makes one final attempt to drag down prices to set new low but the buying pressure at around the previous resistance turned now support level at point E is just too great.

By this time bulls are in full control and takes the price to new high. Thus the uptrend commences henceforth.

SIGNIFICANCE OF VOLUME

Volume plays a significant role in carving this elegant pattern. Volume reflects direct buying and selling interestes between bulls and bears.

In general, volume should increase in the direction of the trend.

Reflecting on the role played by volume in carving this pattern above, volume should increase significantly on the breaking of the downtrendline and the resistance line along the swing C-D.

Significant increase in volume is necessary as it plays crucial role in shooting the price from the support level to new high in the case of double bottom pattern.

That is not the case with double top pattern as price tend to fall off of its own gravity from the high point.Next it should decline on the return move along swing D-E. Then finally, it should again expand along the swing E-F.

-

Return to

- Double Bottom

- Candlestick Analysis

- Home

Have your say about what you just read! Leave me a comment in the box below.